Rohan Bhuchar

“As someone new to the financial markets, I was initially overwhelmed. AQI cut through the noise and made investing feel clear, structured, and approachable. The platform gave me the confidence to take decisions without confusion.”

About

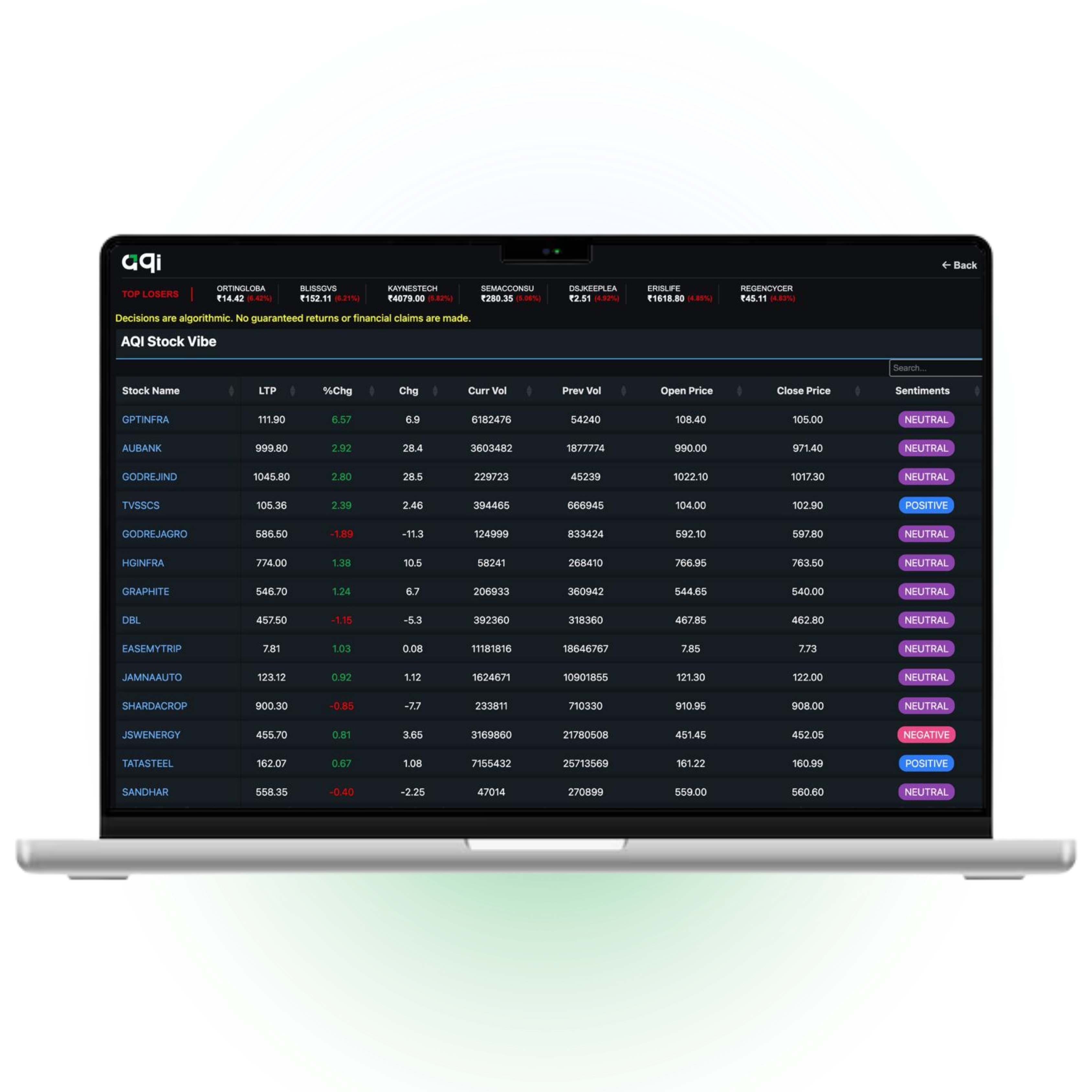

AQI is a fintech company that filters stocks using a complete forecasting approach, starting from sentiment analysis, moving to fundamental forecasting, and finally integrating technical forecasting to build strong conviction within its selected universe of stocks.

Testimonials

Professionals, first-time investors, and business owners use AQI tools to interpret markets with more clarity.

“As someone new to the financial markets, I was initially overwhelmed. AQI cut through the noise and made investing feel clear, structured, and approachable. The platform gave me the confidence to take decisions without confusion.”

“I always believed smart investing required years of expertise, until AQI proved otherwise. The tools are intuitive, practical, and results-driven. Seeing measurable progress within weeks completely changed my outlook on investing.”

“What truly sets AQI apart is its strong focus on risk control. Knowing my investments are monitored and protected gives me real peace of mind, especially during volatile market phases. It helps me stay calm and rational.”

“AQI’s platform has been a game-changer for my lifestyle. The platform works seamlessly in the background, ensuring I never miss opportunities, while I stay focused on my career. It’s efficient, reliable, and incredibly reassuring.”

“With AQI, investing no longer feels like guesswork. Every decision feels calculated, data-backed, and well-informed. It’s a smarter, more disciplined way to approach the markets, and I would confidently recommend it.”

“The level of transparency AQI provides is exceptional. I can clearly track performance and understand what’s happening with my investments at every step. That clarity gives me both confidence and control.”

Our system organizes complex financial datasets into simplified, context-rich views.

It processes structured and unstructured inputs such as fundamentals and sentiment.

No. All outputs are informational and based on automated analysis of publicly available data.

The platform monitors price movements, financial metrics, sentiment patterns, and market activity.

Yes. The interface is designed to simplify multi-company comparisons by aligning metrics.

Data is refreshed continuously based on source availability.

Have questions or want to learn more? Fill out the form and our team will get in touch with you shortly.